KPIs are the metrics that are used to measure the success of a company. They can be quantitative or qualitative in nature, and they help managers understand how well their company is performing.

A startup typically has a lot of KPIs (Key Performance Indicators) to track, so it’s important for them to have a library of KPIs that they can use for various purposes. This will help them save time and energy when they’re looking for metrics on specific topics.

A startup’s success depends on many metrics. During the extensive span of my career in data, I have noticed that many founders and startup managers are struggling with defining the right KPIs and metrics to guide their business to success. This is the reason why our team at SageData gives enough time and attention to defining KPIs and Metrics for a business before we dive into analytics and reporting. this usually takes just a few days and saves a ton of time during the subsequent efforts in visualizing data and reporting on company Key Performance Indicators (KPIs).

Think about it this way. You are in a race and you want to get to the finish line first. Before your competitors get there. Would you not want to spend some time checking the terrain and looking for shortcuts? It would be a terrible mistake to jump behind the wheel of a car and race to the finish line to find out halfway through the race that you are taking the longer route or, worse of all, not even heading in the right direction.

So where do you start?

Here are the 3 easy steps to set you up on your KPI journey.

- Start with 20 KPIs

- Separate Dimensions from Metrics

- Watch our for Performance Indicator Hierarchy

The 20 KPIs

That is all it takes. Just 20 Performance Indicators would already make wonders for your business if they are well defined and connected to actions that can steer your company in the right direction.

Separate Dimensions from Metrics

Do not bundle in dimensions together with transactional Performance Indicators. If you would like to measure Customer Lifetime Value, it is 1 KPI. All too often I see managers listing KPIs in a KPI Library and there is a laundry list of similar KPIs:

- Customer Lifetime Value by Gender

- Customer Lifetime Value by Country

- Customer Lifetime Value by Product

- Revenue by Product

- Revenue by Customer Type (New vs. Returning)

and the 20 KPIs slots fill up very quickly.

But the good news is that this is not a list of the 5 Performance Indicators listed above. It is 2 KPIs:

- Customer Lifetime Value

- Revenue

split across 3 dimensions

- Gender

- Country

- Product

Watch out for KPI Hierarchy

As you go through the definition of your KPIs, make sure you define basic KPIs first, before you go into the higher-order KPIs. What do we mean by that? Well, a CLV (Customer Lifetime Value) is a sum of revenue for each of your customers over their… lifetime or however long you choose it to be. So you need to define what is Revenue first before you define CLV. If you do not invest the time into the basic startup KPIs first, your higher-order KPIs will be incorrectly defined and you will have to go back to the drawing board once you realize that your higher-order KPIs are not reflecting your business as they should.

How long does this take to define Performance Indicators?

We typically spend about 5 to 10 hours per week working with the managers on listing, clarifying, and fine-tuning their list of 20 KPIs and Metrics. The hardest part is getting the stakeholders into the meetings where we

- Define the top 20 KPIs, which are important for the business

- List their description

- Clarify the calculation formula for each KPI

- Link them to the actions that will be taken based on the KPIs performance

- Link the KPIs to Data sources

In the best-case scenarios, we had seen this done in less than a week and as little as 1 meeting.

What tools can you use to help yourself?

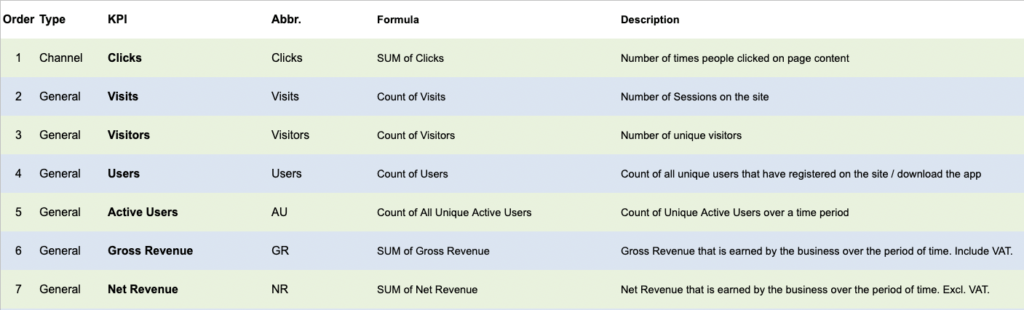

We often use KPI Library for this exercise. A KPI library ensures that everyone in your company who is working with data (and we hope it is EVERYONE), speaks the same language. This ensures that questions such as “Does gross revenue include VAT?” and “How do we calculate % ROAS?” are answered simply and pragmatically – with a link to the KPI library where the person who asked the question can look up the right formula and description for each KPI and Metric in question.

Imagine how everyone in your company knows the KPIs and formulas used to steer the business and everyone is on the same page!

If you do not have a KPI Library, feel free to use the SageData KPI Library Template to get you started on the right foot.

Few words of wisdom

Avoid vanity metrics, such as Number of Customers. Why? Well, what are you going to do with Vanity Metrics? So, you have 20 customers today. tomorrow you have 30. So what? Maybe you will say: “Ah, but now I know I have increased from 20 to 30 in 24 hours”, but now you are talking about a different metric – now you are focusing on % change in customer base and that is not a vanity metric. % change in customers can now be tied back to your marketing spend and marketing efforts and lead to another metric, such as CLV (for each one of the 20 or 30 customers). And from there you can go into the % ROI on marketing spend and now you are connecting the money you are spending to acquire your customers with the money you are making from them and this is the basic foundation for measuring business profitability, success, and attaining your goals.

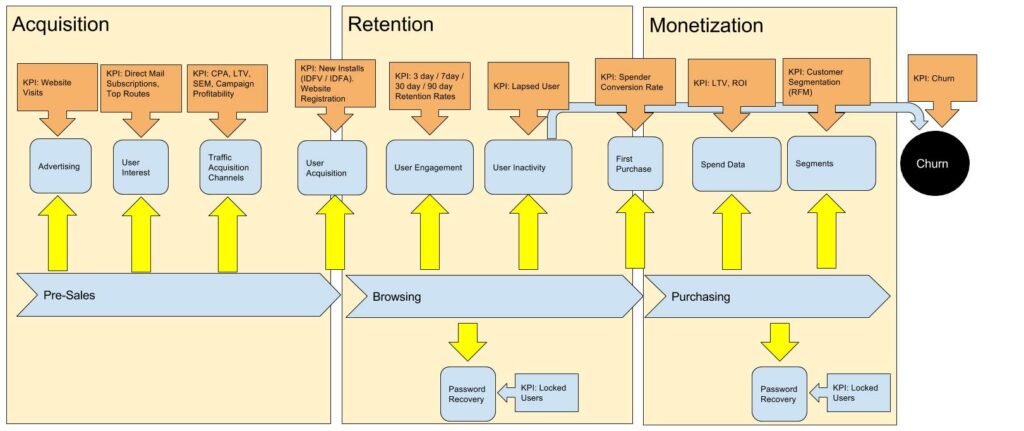

Do link your KPIs and Metrics to the customer journey through your product or service. This way you will know what KPI to focus on if you want to improve a particular step in the customer journey.

Some examples to get you started

Some of the most important ones are customer acquisition, conversion rates, and retention rates.

The metric that is often overlooked is the customer lifetime value (CLV). CLV is calculated by multiplying the average customer lifetime with the average revenue per customer. For example, if an average customer stays for 1 year and spends $100 per month, then their CLV would be $1200.

Start with some simple funnels, such as visitor -> registered user -> customer (someone who purchased).

Maybe segment your customers between first-time buyers and repeat customers.

Check out whether cohort analysis makes sense for your business. Cohort conversion rates are a fantastic way to measure the success of your marketing activities over time.