Business Intelligence for Accounting

Business Intelligence for Accounting

Benefits of Having Business Intelligence for Accounting for your Business

Accountants are an important asset to every business – no matter big, small, well-established, or a startup. Keeping track of all finances and other business operations, processes, and factors is a must.

To alleviate the accountants’ work and reduce their daily stress levels, many business owners are turning to Business Intelligence for accounting.

For what purposes Business Intelligence for Accounting would be useful for your business?

Traditional accounting methods are way too outdated for the fast-paced world that we live in. And the first thing Business Intelligence for accounting as a service offers is the automation of the data entry processes. No more old-school spreadsheets that not only look boring but are also hard to understand and accumulate.

Furthermore, accounting Business Intelligence tools provide the team with valuable insight into how to better communicate finance roles, budgeting, and other important matters with clients.

How can Business Intelligence for Accounting help you improve overall business performance?

Other benefits of Business Intelligence for accounting include:

- Access to better organized and analyzed numerical information and other types of data;

- Possibilities to develop a holistic accounting strategy;

More efficient bookkeeping; - Accurate financial information provided by the accountants;

- Possibilities for managers and CEOs to make informed data-driven decisions;

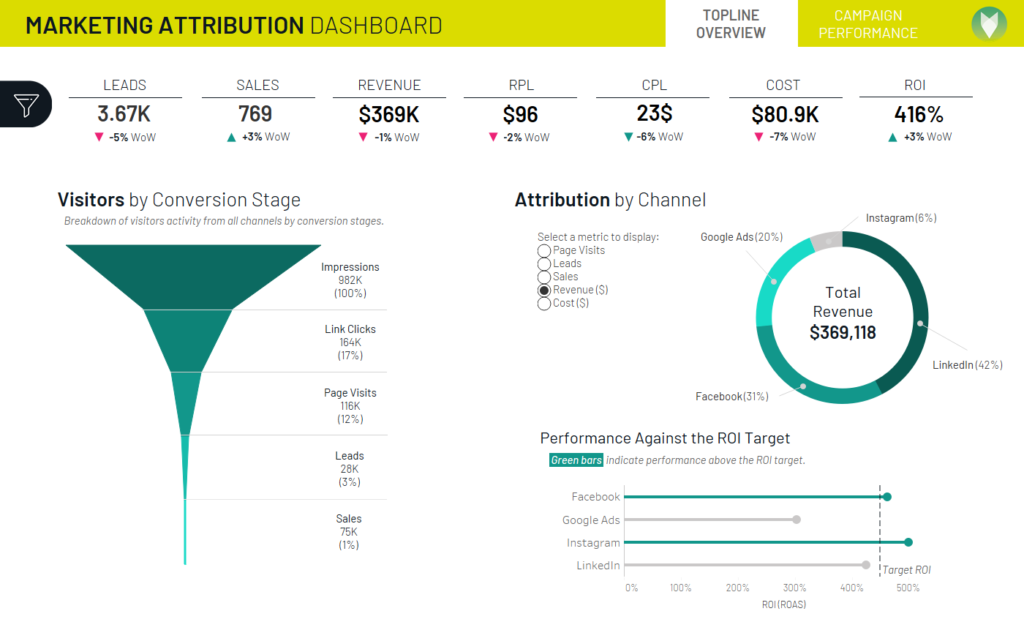

- Customizable Dashboards where accountants can arrange crucial KPIs however they please;

- Access to performance measuring software.

Business Intelligence Solutions from SageData

Accounting and Business Intelligence go very well together. SageData will help you make your business thrive by helping you develop business intelligence solutions.

Area of expertise

To help you achieve all your goals, we have gathered a team of professionals with more than 20 years of experience. Data Analysts, Market Analysts, Data Warehouse Architects, and Data Engineers are here to guide you every single step of the way.

SageData’s most crucial benefits

What makes us stand out is our personalized and entirely customized solutions which are always tailored to the business’ specific needs. Many things are considered when developing a solution – business niche, objectives, the way the business operates as a whole, etc.

What other tools do you get access to?

Apart from access to our impeccable team, getting a complete business intelligence solution from SageData also gives you access to:

- Variety of software – RFM Analysis software, KPI Dashboard software, Management Reporting Software, etc.;

- Entirely customized Data Warehouse – Your information will be stored in a specifically developed and tailored to your needs Data Warehouse;

- 140 Data Integrations – The more sources you connect with, the more data we will be able to collect;

- KPI Dashboard – A place where you can arrange and customize your most crucial KPIs;

- Automations – Automated processes eliminate manual data entry errors;

- Customer segmentation – Follow which customer groups are more valuable to your business.

How BI Software works

Your data goes through three different stages before you see it analyzed and visualized. Those are:

Data Collection

Here, your information is pulled out from all Data Sources and is transferred to the Data Warehouse.

Data Manipulation

During this process, your data goes through many analysis subprocesses, like Cohort Analysis, Forecasting, Anomaly Detection, etc.

Data Visualization

Allows you to convert your analyzed data into creative, engaging, and easily digestible graphic reports.

Frequently Asked Questions

Modern accounting methods are strongly intertwined with traditional ones. What differentiates the two is that all modern accounting processes are way more efficient just because they are automated.

This eliminates possibilities for human errors of any kind, especially from manual data entry. Reporting, dashboarding, and laying out components, for instance, are some of the accounting practices that are completed daily by accounting teams. Automation, however, alleviates their tasks and saves them valuable time.

Yes, they can. To keep track of trends, or identify valid solutions for any ongoing problems, accountants need accurately provided data. Thankfully Business Intelligence gives them access to that.

Absolutely. Accountants can keep track of various metrics, some of which are strongly related to how finances are handled in the organization. For instance, the return of investment on new employees, how well cost-controlling measures work, etc.

KPIs are entirely customizable on different levels – company, department, etc. Your employees can bring out and arrange those KPIs that are of greatest importance to your company’s needs. However, some common examples, for instance, are the number of errors in invoices, the amount of time it takes for an invoice to be paid and the amount of time it takes for errors to be fixed, etc.

Accountants work with big loads of analyzed data. That amount of data may be too much to process, especially if presented in a regular non-visualized way.

Creative and engaging reports, full of graphs, tables, scatter plots, etc., provide opportunities for the readers to better understand the content. Reports can be shared with anyone – from other employees to managers and CEOs.